- Photo Credit: China Ventures

Investment Advisory

China Ventures investment advisory services are designed to assist clients in making informed financial decisions, optimizing their financial strategies, and accessing critical investments and acquisition opportunities.

We pursue a partnership approach across industries and geographies which will be able to leverage our resources with the combination of financial expertise, in-depth industry knowledge and innovative financial solutions.

Our financial expertise can help in all aspects of investment lifecycle, including:

⬝ Deal Origination

⬝ Sources of Finance

⬝ Business Plan and Valuation

⬝ Deal Structuring

⬝ Exit Strategy Management

Sustainability is a fundamental principle that guides our work. Our approach combines rigorous analysis, creative thinking & innovative solutions

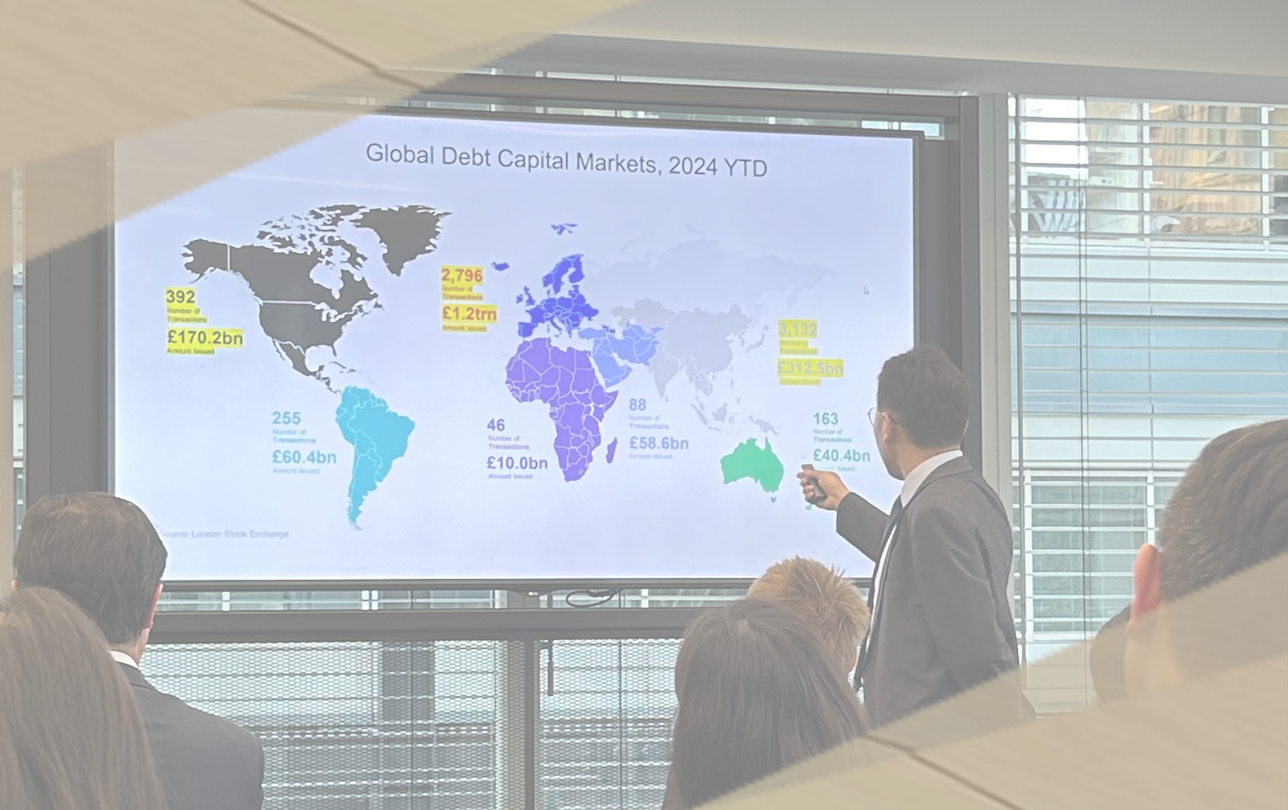

PROJECT FINANCE

We understand the priorities of needs in infrastructure and foundation, new model of financing is diverse and evolving.

We focus on green finance and projects having long-term sustainable growth that creates social value to all stakeholders; Our practices range from energy, industries, agriculture, rail & road, education and healthcare, etc

We work closely with corporates, private capital and DFIs across our global network to provide financing solutions suits client needs, investor appetite and varying markets.

MERGERS & ACQUISITIONS

Corporates recognize the importance of Merger and Acquisition (M&A) strategies in increasingly competitive and dynamic market environments.

We provide Mergers & Acquisitions services across a broad range of industries, to help corporates access new markets, intellectual property, technologies, personnel, assets, and sources of finance, etc.

ALTERNATIVE INVESTMENT

We engage with venture and private equity investors, and fund managers to broaden its investment horizon and diversify risks. We assist client to conduct comprehensive due diligence, risk assessment, and optimise exit strategies.

We leverage our expertise in strategy, operations, and finance by realizing operational efficiencies and synergies to drive growth and unlock value in portfolio companies across both traditional and non-traditional asset classes, including digital RWA. In particular, we integrate assertive consideration on Environmental, Social, and Governance (ESG) within our decision making.